30% ruling for foreign employees

When you or one of your employees receives a 30% ruling decision from the Dutch Tax Administration, it must be processed on the payslip.

Below, we will explain how this works and the possible exceptions that may arise. We will not delve into the rules for qualifying for the 30% ruling or how to apply for this ruling, but will focus solely on the processing aspect within payroll administration.

Searching for affordable payroll administration and a trustworthy partner to handle this? We have an average rating of 4,9 stars on Google and our services start from as low as € 10,25 per month for 1 employee.

Want to know more? On this page we tell you all about our services!

What is the 30% ruling on the payslip?

The 30% ruling is a tax advantage for employees, reducing their taxable salary (gross salary) by up to 30%. The taxable salary is the amount used to calculate wage tax. Under the 30% ruling, up to 30% of the salary can be exempt from tax (referred to as the tax-free reimbursement), resulting in a maximum 30% reduction in wage tax for the employee. After deducting this tax, the amount of the 30% ruling is added back to the net salary. In simple terms, this means the employee receives this part of the salary as a net benefit.

Please note that from January 1, 2024, there has been a change in the maximum tax-free reimbursement under the 30% ruling. You can read more about this change later in this article.

An important condition for applying the 30% ruling is that the fiscal wage on an annual basis must not fall below a fiscal minimum established by the Dutch Tax Authorities. Previously, employees were required to have specific knowledge or skills that were difficult or impossible to find on the Dutch labor market. Since checking or proving this expertise was quite challenging, the Tax Authorities decided to establish an income threshold instead. This allows some measure of the employee’s expertise to be assumed. These threshold amounts are set annually.

However, there is an exception to this requirement:

For employees under 30 years of age who hold a Master’s degree obtained from a Dutch research university or a similar degree obtained from a foreign institution, a reduced fiscal minimum threshold applies.

The annual minimum salary threshold for employees without this Master’s degree:

| Year | Annual salary | Month Salary | 4wk salary |

| 2025 | € 50.436,- | € 4.203,- | € 3.879,- |

| 2024 | € 46.107,- | € 3.843,- | € 3.547,- |

| 2023 | € 41.954,- | € 3.497,- | € 3.228,- |

| 2022 | € 39.467,- | € 3.289,- | € 3.036,- |

The annual minimum salary for employees with this (similar) Master’s degree:

| Year | Annual salary | Month Salary | 4wk salary |

| 2025 | € 38.338,- | € 3.195,- | € 2.949,- |

| 2024 | € 35.048,- | € 2.921,- | € 2.696,- |

| 2023 | € 31.891,- | € 2.658,- | € 2.454,- |

| 2022 | € 30.001,- | € 2.501,- | € 2.308,- |

In addition, the Tax Authority sets an annual maximum salary over which the 30% ruling can be applied. For the year 2024, this is set at €233,000 per year.

Important change from 2027

From 2027, the percentage of the 30% rule will be adjusted. From 2027 the percentage will be 27% of the salary.

If the 30%-ruling started with the employee before January 1, 2024, a maximum of 30% of the salary may be paid tax-free for 5 years.

When the 30% ruling started after January 1, 2024:

– Up to 30% of the salary may be paid tax-free in 2024, 2025 and 2026. The minimum amount remains €46,107 for these years.

– From 2027, a maximum of 27% may be paid out tax-free. The income standard in this case goes to €50,436,- from 2027.

What our customers say:

Greg Burke

Laterne Rouge

Mariel Schaab

Simple online payroll administration

| Affordable payroll administration |

| Direct personal contact |

| Very fast response times |

| No complicated technical terms |

Request information

Due to the condition of the minimum taxable salary on an annual basis, there are two situations:

1. The maximum tax-free reimbursement can be applied to the salary

2. Applying the maximum tax-free reimbursement results in the salary falling below the tax threshold

1. The maximum tax-free reimbursement can be applied to the salary:

When an employee’s taxable salary remains above the fiscal minimum threshold after applying the 30% ruling, there is essentially no issue, and the maximum tax-free allowance under the 30% ruling can be applied monthly.

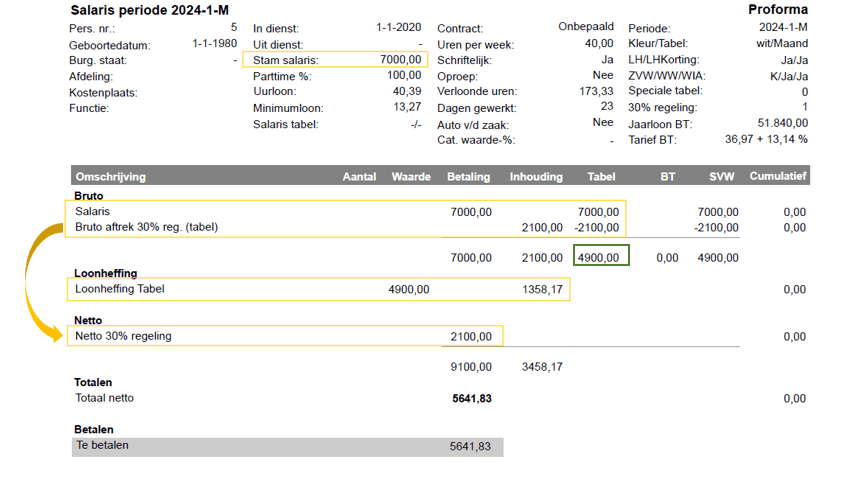

In the example below, the employee earns €7,000 gross per month, and the full 30% ruling can be applied. €7,000 * 70% = €4,900 (see the green box). The fiscal minimum annual salary for 2024 is €46,107. This amounts to approximately €3,843 per month. The taxable salary of €4,900 is therefore higher than the fiscal minimum per month and thus poses no restrictions.

2. By applying the maximum tax-free allowance, the salary falls below the fiscal norm:

When an employee receives the full applicable tax-free allowance and as a result falls below the fiscal minimum wage, we must reduce this percentage to maintain the fiscal minimum wage.

See the example below for more explanation:

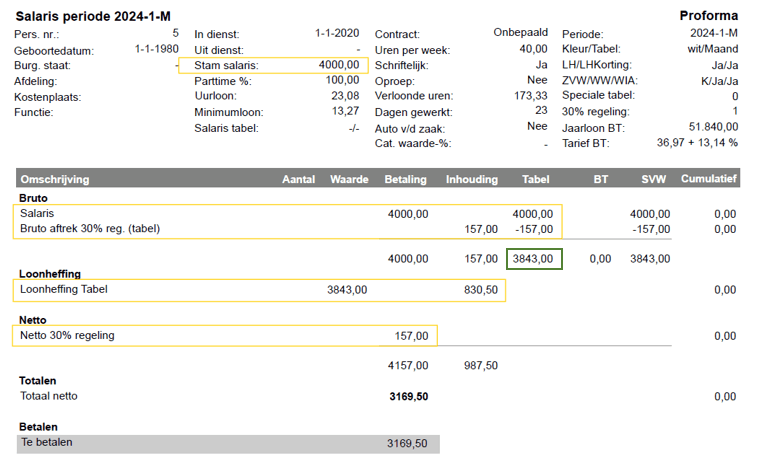

The fiscal minimum annual salary for 2024 is €46,107. This amounts to approximately €3,843 per month. If the employee’s taxable salary without applying the 30% ruling is €4,000 per month and we apply the maximum 30% reduction, the taxable salary would be €4,000 * 70% = €2,800. This is lower than the established €3,843 (see the green box).

Therefore, the maximum tax-free allowance that can be applied in this case is: €4,000 – €3,843 = €157.

Note that this taxable salary is calculated on a cumulative basis. Therefore, if there is still fiscal room from previous periods in a given month, it is allowed for that month to fall below the fiscal norm. However, on a cumulative basis, the norm must be maintained, and no more tax-free reimbursement may be applied than is applicable at that time. In other words: never more than 30%, 20%, or 10%.

For extraterritorial costs, additional expenses incurred by an employee to come to the Netherlands from another country to work, there are two possibilities: the application of the 30% ruling and the actual extraterritorial costs.

It is expected that employers, especially when transitioning to a 20% or 10% tax-free allowance, will switch to the method of actual extraterritorial costs, where the actual extraterritorial expenses are processed. This could be more advantageous for employees in some cases. However, employers should be aware that this will bring significant administrative burdens. In that case, incurred costs must be declared and substantiated with evidence. This could lead to substantial additional administrative work for the employee, employer, and tax authorities.

Be aware that the choice to switch between these two schemes can only be made on January 1 of the respective year. The choice then applies for the entire calendar year.